audit vs tax vs consulting

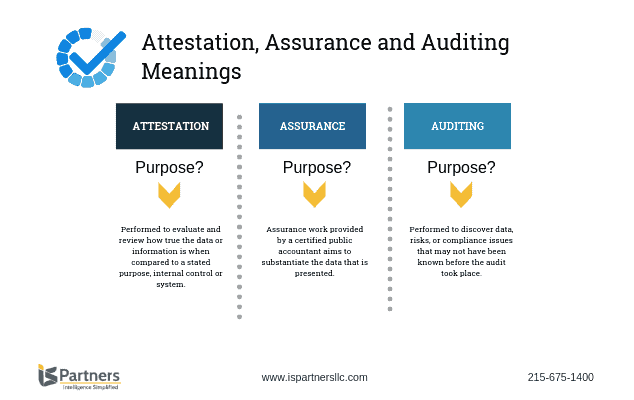

An example of scale. Below is a tabularized representation of the differences between choosing a career in tax vs audit.

Tax Or Audit That Is The Public Accounting Question

Tax accountants typically work individually.

. Tax has a more specialized focus. Moving from audit to TAS isnt easy but isnt like getting into either. One caveat is that many firms will not hire undergrads directly into their TASFAS groups.

Auditors work with clients from day one where. Deloitte Indias insights on several contemporary economic issues. A Spotlight on Indian Economy - Challenges Opportunities Deloitte India.

Consulting vs Auditing Salary. I would say if no boutique consulting. Having pursued my article ship for the past few months and just some knowledge of the subject I might throw into some light on this.

Audit vs Tax Tax vs Audit. Where as auditors work in teams. The problem with consulting is the exit opportunities are more limited than auditing because most companies dont need an in-house person who does what a consultant does.

A first-year auditor at Big 4 firms has an average salary of 58000year. Has a broader focus than tax. Below is a tabularized representation of the differences between choosing a.

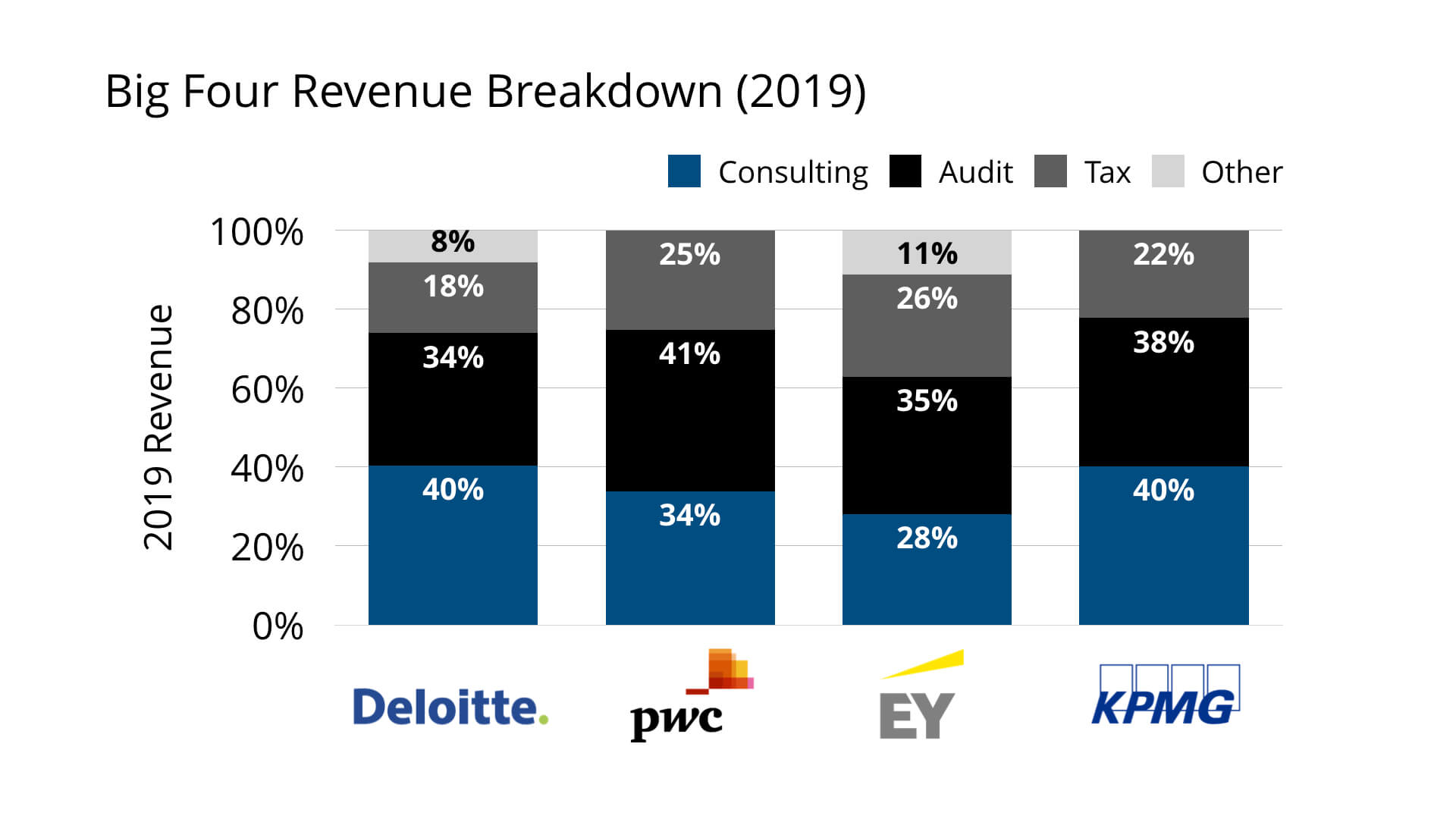

02172010 I was wondering what you guys think is the better career path since it looks like Ill be stuck in accounting for a bit. Diversified industry experience to sell. Compared to auditing a consulting career is more open to various backgrounds offers higher salaries and perks 80000year base for consulting vs 50000year for auditing along.

Apr 9 2015 - 342pm. Lets dive into the pros and the cons of deciding between tax vs. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB.

Answer 1 of 7. A first-year auditor at Big 4 firms has an average salary of 58000year. The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors.

Exposure to a wider range of industry financial reporting. Accountants perform services such as preparing tax returns auditing a companys financial records and designing strategies to reduce a companys tax obligations. The Big 4 firms pay their consultants over 30 more than auditors.

Salaries in the accounting field are attractive as well with the median annual wage for accountants and auditors at 67190. The top 10 percent. Audit vs Tax Tax vs Audit.

Here are some of the differences between both options. Any suggestions are most.

Omc Audit Tax Financial Advisory

What Is An Audit The Best Guide On The 3 Types Of Audits Ageras

Big Four Accounting Firms Which Is Best For Consulting

![]()

Audit Consulting Law Legal Services Tax Icon Download On Iconfinder

Texas Tax Defense Group Texas Tax Consulting Group

Nonprofit Systems Consulting Accounting Services Audit Tax And Consulting Aronson Llc

Sec Questions Auditor Independence As Firms Advisory Work Booms

Tax Vs Audit At The Big 4 Youtube

Choosing Between Tax Audit Consulting Youtube

Gray Areas In State Sales Tax What You Need To Know Now Miles Consulting Group

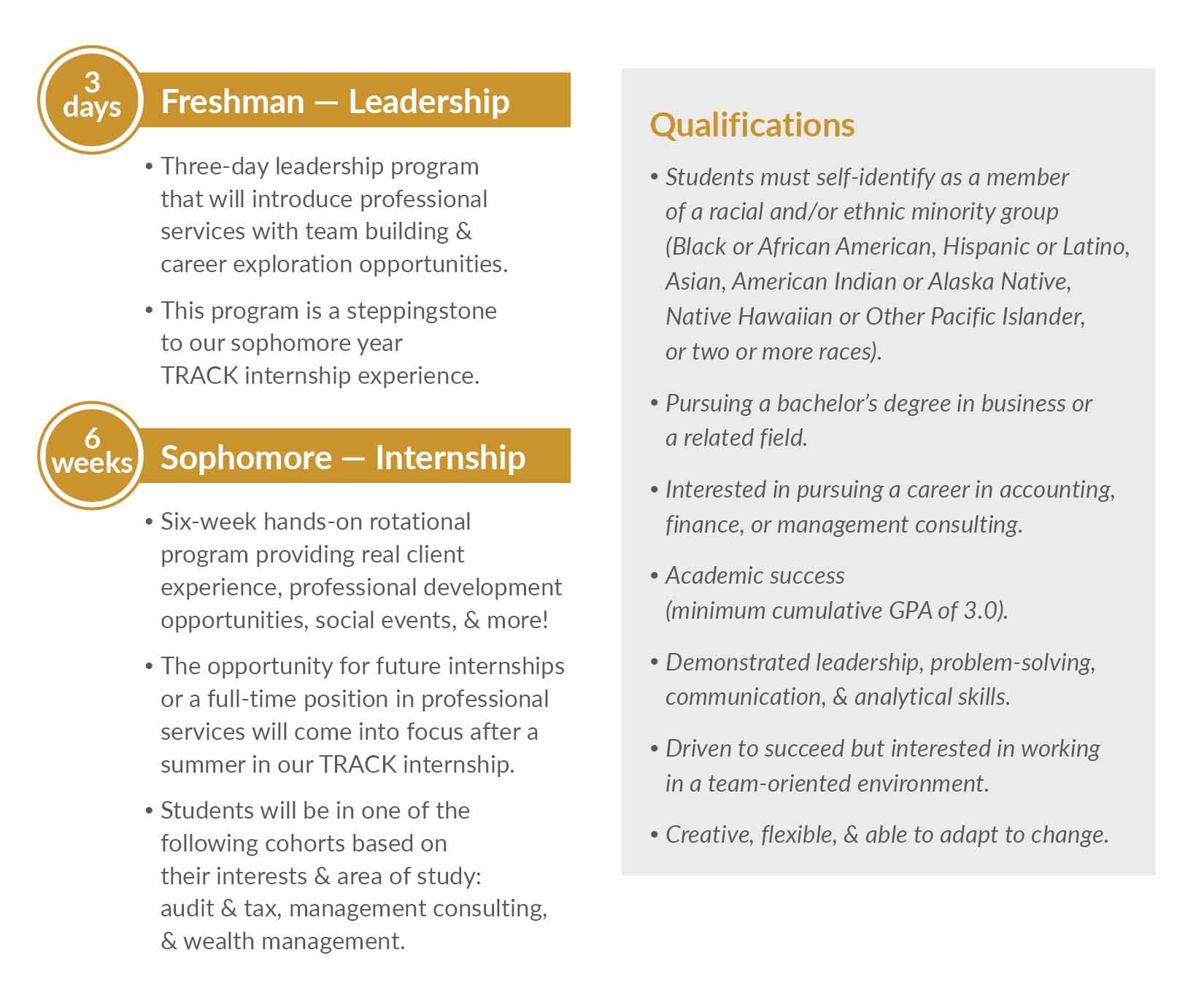

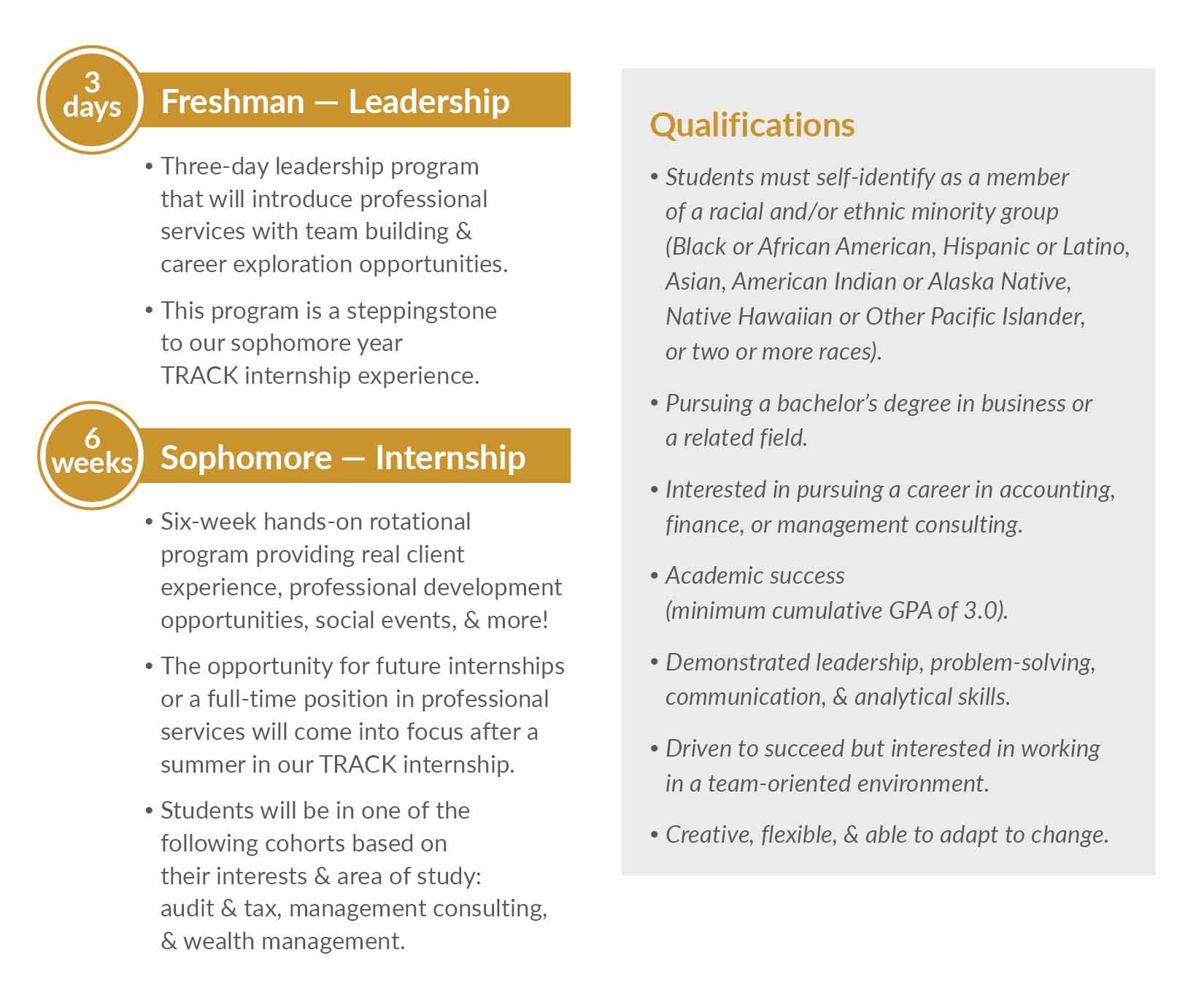

Life On Track A Unique Plante Moran Intern Experience Our Insights Plante Moran

Blog Tax And Regulation Alerts Tax Audit Consulting Topel Forman Llc

Pwc Audit And Assurance Consulting And Tax Services

Audit Vs Tax The Accounting Major S Major Decision

Accounting Firm For Tax Audit Advisory Services Windes

Acua Advisory Services Balancing Value And Independence

Ppt Audit Vs Tax Powerpoint Presentation Free Download Id 6725761